How to Set Yourself Up for Financial Success This Year

By Byron Ellis

People often treat budgets like diets: fiendish torture devices designed to suck the joy out of life.

And the truth is…yeah, they do feel like that sometimes.

But think about it this way instead. A budget is just a plan to help you be financially happy.

That doesn’t mean cutting out all of the things you enjoy. It means focusing on the things that are important to you, and making small sacrifices in the short term to achieve those bigger goals in the long term.

So don’t worry. If you have anxiety every time you open your banking app, these 5 steps will help you start living your best financial life!

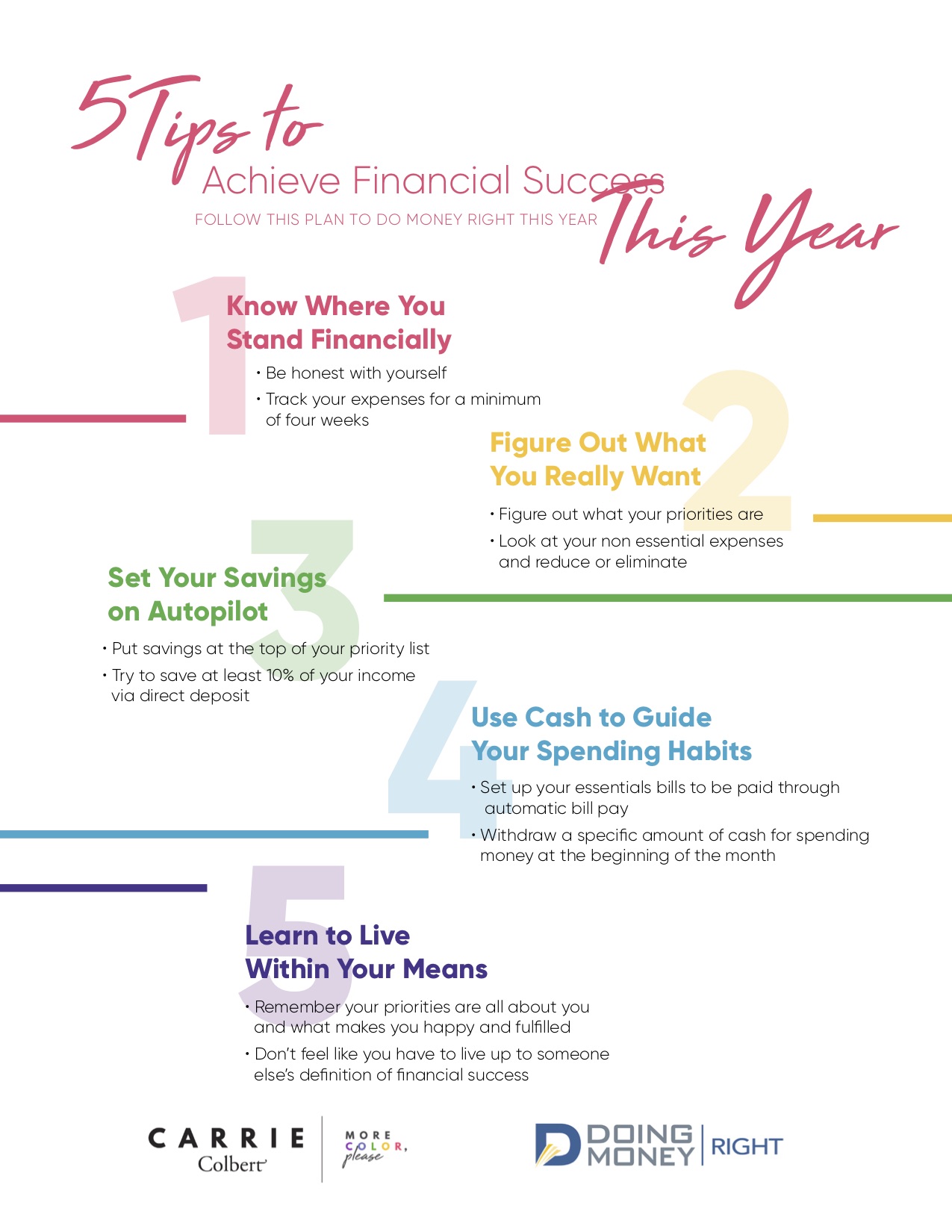

1. Know where you stand financially.

Owning up to your spending can be pretty tough. But to make a budget work, you have to be honest with yourself.

The first step is to track your expenses over a period of time. I suggest four weeks at the minimum. The easiest way to do this is by using your banking app or a budgeting app like Mint, but it’s also a great time to crack open that notebook you bought at Target six months ago and never used.

Don’t pretend like you don’t have one!

Once you know where your money is going, the hard part is over; now you just have to figure out where your money should be going.

2. Figure out what you really want.

Decide what your best life really looks like. Figure out what your priorities are; it might be saving up for something big, like getting out of your apartment into a house, or it might just be treating yourself to a coffee every morning.

Of course there are things you have to spend money on. Rent, utilities, insurance…you probably can’t do much about those.

But look for non-essential expenses, especially recurring ones, that you could reduce or eliminate and use that money elsewhere.

If you’re spending extra money on something that isn’t a priority, KonMari that @$%#!

3. Set your savings on autopilot.

When figuring out your priorities don’t forget to put saving at the top of the list.

I know putting money into savings isn’t very exciting. But it’s one of the most important steps towards achieving full financial independence.

A great place to start is saving at least 10% of your income, and the best way to do it is through direct deposit. The idea is to put aside that money early enough so that you don’t see it; that way you won’t be tempted to use it.

If you can’t do 10% right now, don’t worry! Start small and work your way up.

4. Use cash to guide your spending habits.

Using credit cards can make it easy to track your expenses, but can also make it far too easy to overspend.

Set up your essential bills to be paid through automatic bill pay. Then make a plan to withdraw a specific amount of cash for spending money at the beginning of the month.

Just like with the direct deposit, this forces you to make better spending choices by deciding where every dollar goes.

Believe it or not this is also really freeing, because the cash can be used to buy whatever you want, guilt free. Yay more Target notebooks!

5. Learn to live within your means.

So here you are. You figured out how much you’ve been spending, defined your priorities going forward, and made the changes necessary to fulfill those priorities without having to stress about it. Good job!

But what if you want more? What if, after all your bills are paid and your savings are put away, you can’t afford the things you really want?

Remember your priorities are about you; what makes you happy, and what makes you feel fulfilled in life. Don’t feel like you have to live up to someone else’s definition of financial success.

A budget won’t make you more money, but it will help you live better with the money you have.

Great tips! On our personal finances, we made it a point to save and not live beyond our means. We have been blessed to live debt free and are saving towards a home… when we can finally settle and the military doesn’t move us. Now business wise, I need to get better about my investments. I invested in some bad areas last year so this year is about being more strategic where I put my hard earned money.

That’s awesome, Nicte! Nothing will weight you down more than debt.